Maine Tax Credits For Ev Purchase

Maine Tax Credits For Ev Purchase. New purchaser agreement and tax credit rules. The government is offering a hefty tax credit to buyers of electric vehicles, but taking advantage of it is not straightforward.

Vehicles must be for business and not personal use. The inflation reduction act signed into law in 2022 expanded tax credits ranging from $3,750 to $7,500 for purchases of new and used evs, an effort by the.

Here's What You Need To Know.

What we can verify about the ev tax credit in 2024.

(G) The State Offers An.

But fewer cars might be eligible as.

The Measure, Sponsored By Democratic.

Images References :

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, In addition to efficiency maine’s incentive, you may be. Electric vehicle owners in maine could soon be required to pay a new yearly surtax, under a proposal before the legislature.

Source: www.americanactionforum.org

Source: www.americanactionforum.org

The IRA's EV Tax Credits AAF, Does maine have tax credits for buying new evs? Here's what to know about how they work.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car, Does maine have tax credits for buying new evs? Maine electric vehicle tax credit:

Source: www.autonews.com

Source: www.autonews.com

A list of models that qualify for U.S. EV tax credits Automotive News, Efficiency maine’s ev accelerator provides rebates to maine residents, businesses, government entities, and tribal governments for the purchase or lease of a new ev or. But fewer cars might be eligible as.

Source: ourhealthneeds.com

Source: ourhealthneeds.com

Everything you need to know about the IRS's new EV tax credit guidance, The homepage for efficiency maine's electric vehicle rebates. According to the landmark inflation reduction act of august 2022, you can get up to $7,500 in tax credits if you purchase an ev or a phev, but it very much depends on the make.

Source: 1800accountant.com

Source: 1800accountant.com

Electric Vehicle Tax Credit Explained 1800Accountant, A bill in the legislature would add electric bicycles to the list of vehicles that can qualify for rebates through efficiency maine. One significant incentive for maine residents considering the switch to electric vehicles is the.

Source: avtowow.com

Source: avtowow.com

EV Tax Credits and Rebates List 2022 Guide, With tax credits of between $2,500 to $7,500, it’s worth completing the simple steps to claim. Illinois offers a $4,000 electric vehicle rebate instead of a tax credit.

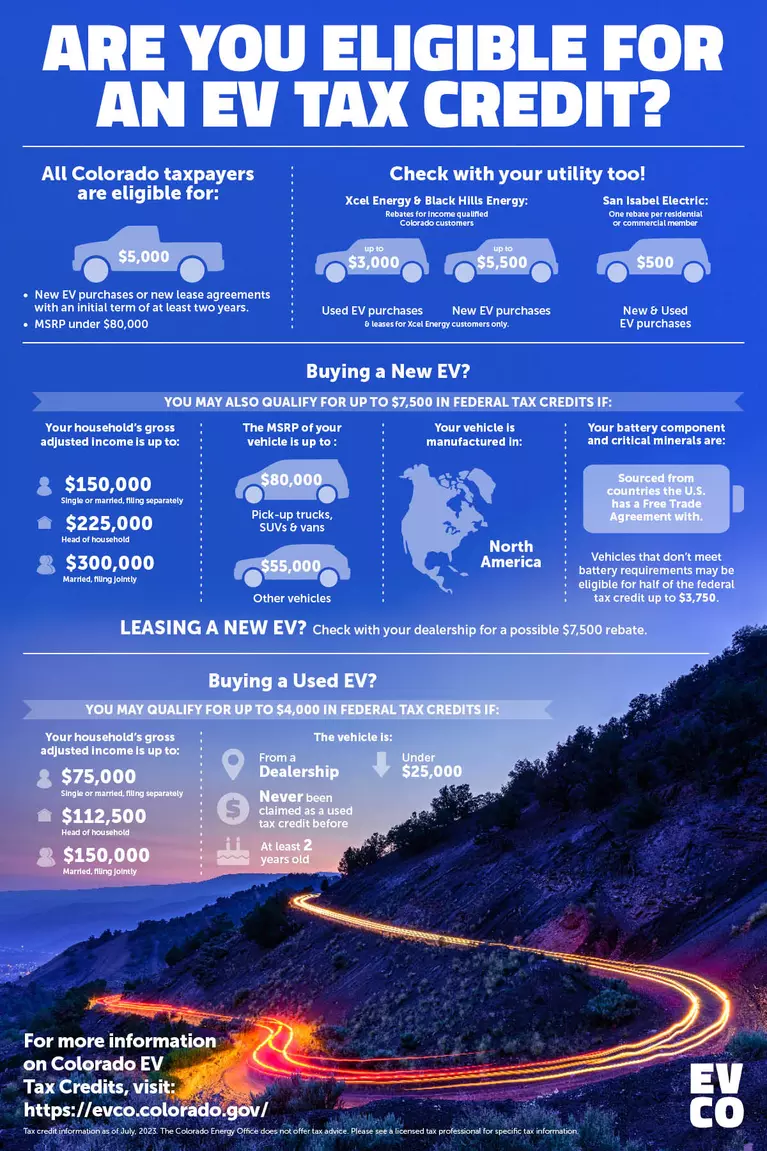

Source: evco.colorado.gov

Source: evco.colorado.gov

Are You Eligible for an EV Tax Credit? EV CO, Efficiency maine’s ev accelerator provides rebates to maine residents, businesses, government entities, and tribal governments for the purchase or lease of a new ev or. The inflation reduction act signed into law in 2022 expanded tax credits ranging from $3,750 to $7,500 for purchases of new and used evs, an effort by the.

Source: enginefault.com

Source: enginefault.com

The 2023 EV Tax Credit Changes Are A Big Deal Who Keeps It & Who, In addition to efficiency maine’s incentive, you may be. One significant incentive for maine residents considering the switch to electric vehicles is the.

Source: taxedright.com

Source: taxedright.com

New EV Tax Credits Taxed Right, Saving money on ev purchases. One significant incentive for maine residents considering the switch to electric vehicles is the.

Here's What To Know About How They Work.

On monday, efficiency maine made several changes to the electric vehicle rebate program, most notably.

Vehicles Must Be For Business And Not Personal Use.

Electric vehicle owners in maine could soon be required to pay a new yearly surtax, under a proposal before the legislature.